In the United States, the thrill of a winning bet or the despair of a loss isn’t the only consideration for gamblers. The Internal Revenue Service (IRS) has its eyes on gambling (judi) winnings, and the taxation of these earnings is a critical aspect that can significantly impact the overall financial outcome for both casual players and high rollers. In this exploration, we’ll delve into the intricate world of gambling taxes in the USA, examining the rules, rates, and nuances that govern this often-misunderstood facet of the American tax system.

1. Types of Gambling Income: Unraveling the Taxable Web

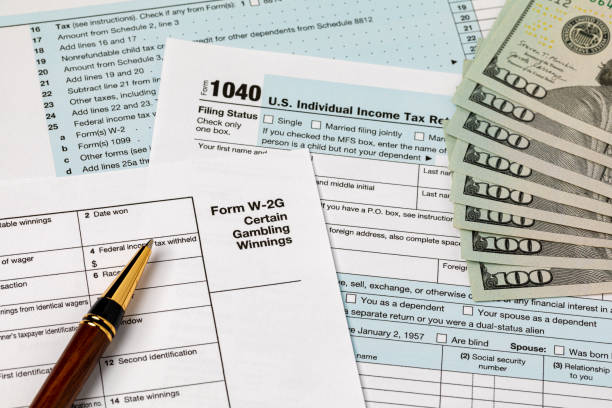

Before delving into the numbers, it’s essential to understand what constitutes taxable gambling income. The IRS considers winnings from various forms of gambling as taxable income, including casino games, lotteries, poker tournaments, and sports betting. However, not all types of gambling income are treated the same, and the rules can vary depending on the nature of the wager.

2. Federal Tax Rates: A Progressive Approach

For most Americans, gambling winnings are subject to federal income tax. The tax rates are progressive, meaning they increase as the amount of taxable income rises. At the time of my last knowledge update in January 2022, the federal tax rates for ordinary income ranged from 10% to 37%. Gambling winnings are added to a taxpayer’s total income, and the applicable tax rate is determined by their overall income bracket.

3. Withholding Requirements: Instant Gratification for the IRS

In certain situations, gambling establishments are required to withhold a portion of a player’s winnings and remit it directly to the IRS. This is known as withholding tax, and it applies to gambling winnings that meet or exceed specific thresholds. For example, casinos are required to withhold 24% of slot machine winnings that exceed $5,000. This instant taxation ensures that the IRS gets its share upfront, rather than relying on individual gamblers to report their winnings accurately.

4. State Taxes: A Patchwork of Regulations

In addition to federal taxes, gamblers may also be subject to state income taxes, and the rates and regulations vary from state to state. Some states levy a flat tax on gambling winnings, while others use progressive tax rates similar to the federal system. It’s crucial for gamblers to be aware of their state’s tax laws, as these can significantly impact the overall tax burden on their winnings.

5. Professional Gamblers: A Unique Tax Perspective

For those who make a living from gambling, the tax implications can be even more complex. Professional gamblers are required to report their gambling income and can deduct related expenses, such as travel and betting losses. However, establishing oneself as a professional gambler comes with its own set of challenges and scrutiny from tax authorities.

6. Tax Reporting: The Importance of Accuracy

Regardless of whether you consider gambling a hobby or a profession, accurate record-keeping is crucial for fulfilling tax obligations. The IRS requires detailed documentation of winnings and losses, including receipts, tickets, and other records. Failing to report gambling income accurately can lead to penalties and legal consequences.

Conclusion:

The taxation of gambling income in the USA is a multifaceted landscape that requires careful navigation. From federal tax rates to state-specific regulations and the unique considerations for professional gamblers, understanding the tax implications of gambling winnings is essential for anyone trying their luck in the diverse world of games of chance. As the tax code continues to evolve, staying informed and seeking professional advice can help gamblers make informed decisions and ensure they comply with their tax obligations.